Dow Jones Casino

Posted in rantings and ravings on February 5th, 2021 by skeeterSo we got these yahoos — let’s call them investors — teaming up through social media to buy some piddly ass stocks nobody in their right mind would gamble a 401-K to buy, figuring to drive the price through the ceiling by ganging up on their buy bids. They buy some stock called GameStop, the largest video game retailer, operating 5,509 retail stores throughout the United States, Canada, Australia, New Zealand, and Europe, so what if I’ve never heard of it, and in no time flat the price jumps from a yearly low of two and a half bucks to just under 500 american dollars.

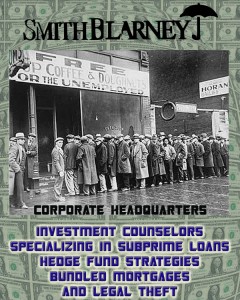

Now, all of this would seem kosher in a world where Tesla stock shot up astronomically even before Elon could start selling his little battery run cars, making him the richest human being on Planet Earth. Nobody denigrated Elon Musk, well, at least not for getting rich on his stock options…. But when this crowdsourced party of know-nothing investors hit the jackpot, the market pulled the plug on their trading. Why? Because the hedge fund millionaires who had made investments in ‘instruments’ that specialize in betting against the success of GameStop (hence the term hedge fund, as in hedging their bets) suddenly found themselves on the wrong end of the deal and lost billions with a B in a flurry of electronic trades, well, no doubt some calls got made to the croupier in New York, scream and yell No Fair to the line judge at the SEC, make threats against who knows who down at the Dow Jones. And voila, trading shut down, mister, and I mean Right Now!

Welcome to the rarified world of high finance. Collateralized debt obligations, derivatives, collateralized loan obligations, futures contracts, short sales, annuities, swaps and options and warrants, probably nothing you didn’t study in high school economics classes, right? The Big Boyz are hiring PhD mathematicians and physicists to run complex algorithms and formulas, dreaming up schemes for monetizing about anything you can buy trade or sell, then calculating odds for profit, figuring out infrastructure to speed the time between buying and selling faster than the competition. Is the system rigged? you might ask and the answer depends on whether or not you’re some schmuck like me who dials in an order from some brokerage or other and maybe a few minutes or longer get a piece of the American Pie. The Big Boyz are trading in nano seconds. Something goes sideways, they have computer programs to bail before you can say Smith Barney.

I heard some talking head yesterday saying the kids driving GameStop prices up through crowdsourcing were going to turn the stock market into a casino, all just a big crap shoot, nothing based on actual worth of a company or a corporation. Well, call me stoopid and slap me with a three dollar bill, but I think the game has been rigged a long time. What happened in Wall Street stayed in Wall Street, just like Vegas. All well and good until the card counters rolled in.

Hits: 201